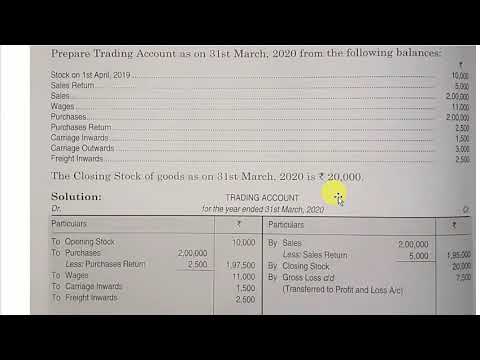

This is important because it shows you how much working capital you have to keep the business running. There are two main financial reports the profit and loss statement and the balance sheet. The profit and loss statements will show the sales, overheads and expenses for the month. The balance sheet shows a snapshot of the business finances including assets and liabilities. The reports are essential for checking the financial health of a business.

Accounting equation

An efficient system for handling business finances is at the heart of every successful business, whether it is an accounting firm or any other small company. Finance planning problems make up 66% of the most common reasons for start-up failure. Many small business owners wonder if bookkeeping will be complicated when they start.

Accounts payable includes feedback inhibition in metabolic pathways any payments owed to suppliers or creditors by a company. Angela Boxwell, MAAT, brings over 30 years of experience in accounting and finance. The most important thing in bookkeeping tasks is getting organised and keeping on top of the work. When comparing accountants and bookkeepers, know that an accountant may also be a bookkeeper. There are key differences between bookkeepers and accountants that you want to know before hiring a financial professional. Maintaining financial records requires a high degree of accuracy and attention to detail.

Save time with expert help

Bookkeeping professionals have their own expertise based on the types of businesses and industries what is federal tax withholding they serve. Any bookkeeper knows one of their key responsibilities is recording accounts payable invoices daily. This task ensures you’ve accounted for all income and properly tracked expenses. Bookkeeping is the system of recording, organizing, and tracking financial transactions and information for a business or organization.

Whether you file your transactions on paper or the computer, your filing should be kept up to date. Some accounting packages allow you to upload images of receipts to their software, which can save keeping hard copies. Scanning of documents, to update the computer system or email to customers or suppliers.

- Filing paperwork usually is by sales or purchases, then by customer or supplier name and then date.

- Topical articles and news from top pros and Intuit product experts.

- This article will show how a detailed checklist can simplify bookkeeping, solve common financial problems, and promote business growth.

- Your accounting ledger serves as the hub for all your financial information—in particular, all your accounts and transactions.

- It is essential to know how much cash as a business owner or bookkeeper is in the bank account.

Backing up data is so crucial at every stage, but we chose monthly for a few reasons. This means that they will have a copy of your records for that month. So, you only need to back that up once a month as the bank records how the irs knows you didn’t report income expire.

Managing Accounts Payable: Tracking and Paying Vendor Invoices

This accounting method is useful for businesses with inventory or accounts payable and receivable. One of the most important items on your checklist is staying on top of deadlines. Each month, there are a number of deadlines you need to meet to keep your clients’ books in order. These can include filing payroll taxes, sending invoices, and reconciling credit card accounts.

Petty Cash

Link My Books can assist you in automating your bookkeeping process. Our tool integrates seamlessly with your sales channels and accounting platforms, automating the bookkeeping process from start to finish. Link My Books is a robust accounting solution that automates many of these tasks. It automatically applies correct information, such as tax rates specific to each country. Monitoring these daily transactions gives you a clearer picture of your business’s financial situation, helping you spot trends and manage budgets. This checklist covers everything from the simplest daily transactions to the most complex year-end reports.

This also means that you can see up-to-date information anytime you want. Then you and they are also able to point out and correct any mistakes there might be before it gets out of hand or are forgotten. Your bookkeeper must also ensure that you have a clear audit trail at all times to prevent theft and fraud.